- Ukraine is an attractive and cost-effective market for investors, even in times of war

- So why is Ukrainian real estate an attractive asset for investors despite the current challenges?

- Legal aspects of buying real estate in Ukraine and tips for foreign investors

- What affects the value of real estate in Ukraine?

- Investing in foreign real estate on the example of the Indonesian and Turkish markets

- Why is it profitable to invest in real estate abroad?

- Why is real estate in Turkey and Indonesia an attractive asset for investors?

- Legal aspects of buying real estate in Turkey and Bali

- Tips for investors - where to invest abroad?

The global real estate market is currently undergoing significant changes, fueled by technological advances and the development of digital economies, which allow investors to expand their operations internationally. At the same time, the Ukrainian real estate market remains attractive for investment. In this article, we will talk with experts about the best places to invest

The world of real estate investment is changing rapidly. In particular, thanks to the development of technology and the spread of the digital economy, investors can now operate far beyond the borders of their country of residence. At the same time, investing exclusively in domestic assets may seem like a comfortable and easy way to make money.

Given the economic, political, and security situation in the world, more and more investors are asking themselves whether it is better to invest in real estate in Ukraine or to enter the international market.

To answer this question, we spoke with two experts: media real estate lawyer Andriy Stavniuk and Anton Taranenko, investor and owner of the international development company AntaGroup.

The advantages and disadvantages of investing in Ukraine and abroad in 2024, as well as a lot of useful information for investors are below.

Ukraine is an attractive and cost-effective market for investors, even in times of war

Ukraine's economy is gradually coming to life, and the country's real estate market is also on the rise. The latest statistics show that the cost of housing in Ukraine is rising, which means that it is once again becoming a promising way to make money. However, like any other market, it has its advantages and disadvantages, especially in times of war.

Advantages of investing in real estate in Ukraine:

● Low cost - Compared to many foreign markets, the cost of real estate in Ukraine is lower, which creates a low entry threshold for investors and makes it possible to acquire assets without attracting financing from a bank.

● Potential - real estate can have a high potential for value growth. Currently, due to the full-scale war in Ukraine, the price per m² in foreign currency has fallen compared to the end of 2021, while after the victory we will see a significant price correction.

Low tax burden for both Ukrainian citizens and non-residents.

No need to confirm the origin of funds (when buying on the secondary market).

Disadvantages and risks of buying real estate in Ukraine during the war and ways to overcome them:

● Political and economic risk - war and political instability can significantly increase the risks for investors, in particular, depending on the timing of the end of the war, the availability and amount of support from Western partners, the value of real estate may continue to decline.

In addition, military operations lead to significant changes in the political situation in the country, including the adoption of new laws and restrictions for men liable for military service, changes in taxation, etc.

How to solve it? According to lawyer Andriy Stavniuk, to mitigate this risk, investors should follow the news and respond quickly to it.

● The risk of destruction/damage to property - as long as missiles and chess pieces are flying, real estate is at risk of destruction or damage, but do not forget that the state pays compensation for damaged/destroyed housing, of course, the investor will lose potential profits from renting out his property, and probably will not receive the full value of his destroyed property, but still a certain amount can be returned even in the worst case.

How to solve the problem? According to Andriy Stavniuk, to mitigate this risk, investors should consider the location of their property, choosing areas with less military activity or considering property insurance. By the way, some insurance companies already provide real estate insurance against military risks.

● Changes in the legal system - under martial law, changes in the legal system may occur, which will have an impact on ownership and other aspects of real estate investment. Also, a large number of Ukrainians sell real estate through a power of attorney while abroad.

How to deal with it? Get advice from a highly qualified lawyer before signing any agreements.

● Economic instability: the war may lead to a decrease in economic activity and an increase in inflation.

How to decide? Investors should consider diversifying their investments, including investments in other assets or regions, to reduce the impact of such instability.

Visit Ukraine on social media: Telegram | YouTube | Instagram | Facebook | Twitter | TikTok

So why is Ukrainian real estate an attractive asset for investors despite the current challenges?

1. Higher yields than in other European countries.

2. Ease of investment and confirmation of the legality of the origin of funds.

3. Low taxation.

4. Legislation that primarily protects the rights of the property owner, not the tenant. You have probably never heard of squatters or occupation in Ukraine?

5. Foreigners can invest in Ukraine under the same conditions and with the same taxes (only 1% of the pension fund fee) as Ukrainian citizens.

Legal aspects of buying real estate in Ukraine and tips for foreign investors

The main difference between the Ukrainian real estate market is the increased legal risk, as neither the state, nor realtors, nor even notaries can guarantee legal purity in real estate transactions. This is due to the specifics of the law. If it turns out later that the seller was dishonest and obtained the rights to the apartment illegally (although the apartment was not under a ban on notarial acts at the time of the transaction) or that the apartment was the subject of a court case regarding the division of marital property, a foreign investor can only find out after the fact.

In order to avoid such situations, use the services of specialized real estate lawyers when choosing an investment property.

Also, Andriy Stavniuk advises to pay attention to the secondary real estate market to the objects that have been owned by sellers for more than three years, otherwise the owners pay an additional 6.5% tax to the budget and simply include this amount in the cost of real estate, in fact, imposing these taxes on the buyer. That is why, in new buildings, one should expect a significant discount after three years from the date when the building was put into operation and investors received the right of ownership.

What affects the value of real estate in Ukraine?

Among the main factors that affect the price of a particular property, I would highlight its characteristics, location, infrastructure, condition and age, damage caused by military operations, and the urgency of sale. Another aspect that emerged during the full-scale war can be added to the current Ukrainian real estate market: the current situation at the front, supply and demand in the real estate market directly depends on the success of the Armed Forces of Ukraine.

Changes in Ukraine's investment climate and advice for investors

No legislative initiative will improve the investment climate as much as Ukraine's victory and the end of hostilities, which is currently what is holding back the real estate market from growing in value.

Investors who plan to buy real estate in Ukraine should remember that "the greater the risk, the greater the return" applies to investments, but does not correlate with the legal component of such investments, so when choosing a property, do not neglect legal analysis and reduce legal risks to zero, and the yield will remain at the same level.

Investing in foreign real estate on the example of the Indonesian and Turkish markets

Investing in real estate abroad promises great returns and is an excellent investment. In general, this is an attractive offer for those who dream of additional income and are looking for an opportunity to obtain permanent residence or citizenship in another country.

Currently, the real estate markets of Indonesia and Turkey are the most promising areas in the world. It is on the example of these two countries that we will consider the pros and cons of investing in housing abroad.

Why is it profitable to invest in real estate abroad?

The main advantages of investing in foreign real estate include:

1. Portfolio diversification - investing in foreign real estate can help investors diversify their portfolio by providing access to different markets and economies. Such diversification helps to reduce overall portfolio risk, as downturns in one market can be offset by growth in another.

2. Potential for high returns - Foreign real estate investments can offer higher return potential than domestic investments, especially in emerging markets or regions experiencing rapid economic growth. By choosing the right properties in promising locations, investors can achieve significant capital appreciation and rental income.

3. Tax advantages - investing in foreign real estate can provide investors with tax advantages depending on the tax laws of their home country and the tax laws of the foreign country.

4. The right to obtain permanent residence or citizenship.

In addition to the benefits, investing in foreign real estate has certain risks that an entrepreneur should consider:

1. Economic instability - fluctuations in economic growth, employment and inflation can affect property values and rental income, potentially leading to lower profits or even investment losses.

2. Political instability - Changes in government policy, political unrest or even conflict can negatively impact property values and the overall investment environment. It is important to carefully assess the political stability of a country before investing in its real estate market.

3. Currency risk - fluctuations in exchange rates can affect the value of investments and profits. An appreciation of the investor's home currency against a foreign currency may result in lower income or losses, while a depreciation may result in higher returns.

4. Cultural differences - It is important to have a good understanding of local customs, language and business practices. Misunderstandings or cultural mistakes can lead to legal disputes, financial losses, or damage relationships with local partners.

Why is real estate in Turkey and Indonesia an attractive asset for investors?

1. One of the highest incomes in the world - the annual income for luxury real estate (from $500,000) in Turkey is from 7%, for standard real estate - 8-10%. The yield on real estate in Bali is 13-16%. The return on investment in Indonesia is 6.5-8 years.

2. Opportunity to receive passive rental income, given that the investor cannot rent an apartment on his own. This can be done through a developer who has the appropriate license or with the help of a real estate company. Each lease agreement must be notarized. You can also rent out real estate by the day only through a specialized company. However, this method is very convenient, because the investor is not limited to the problems of renting out real estate, he only passively receives income from the management company once a quarter.

3. Simplified taxation system - in Turkey and Bali there is no annual real estate tax, you pay it only once when you buy. In the future, the tax is paid exclusively by the developer. The investor only needs to pay for utilities. At the same time, Ukraine has a real estate tax.

4. Simple investment - a foreigner has the right to pay for real estate in many ways: transfer money to an account, pay in cash or cryptocurrency. It is worth noting that currently 95% of real estate sales abroad are made with cryptocurrency.

5. Fast and easy registration - this advantage applies exclusively to Turkey - here you will receive a certificate for an apartment not after the building is put into operation, but when the first stage of construction work is completed. That is, when your apartment has walls, it is already your property and you can sell it, mortgage it, take out loans, etc. This is not possible in Ukraine.

Legal aspects of buying real estate in Turkey and Bali

In Turkey, when you buy an apartment, you sign an investment agreement and the law of the country strictly protects your money. Turkish and Indonesian investment contracts are guaranteed by the governments of the countries. That is, the state confirms that the developer has been checked, because he has obtained all the necessary licenses.

Another advantage is related to the culture of the countries, for example, for the Turks, a foreigner is a privileged person who cannot be deceived. Therefore, you should not be afraid to invest in the state's real estate. In addition, a developer who decides to build real estate in Turkey is obliged to freeze a certain share of assets, which is also a good guarantee for an investor.

How much money do you need to invest in real estate abroad?

Prices for real estate abroad start at $10,000, which is usually enough to buy a certain share of housing. If we are talking about a complete unit, it starts at $100,000. Of course, there are cheaper offers, but it is better to consider real estate that costs more than this price.

In Turkey, a share of an apartment, for example, 25%, will cost on average $30,000-35,000. The cost of an apartment is from $120,000.

Tips for investors - where to invest abroad?

When planning to invest in real estate abroad, we advise you to pay attention to reliable developers with international experience.

Examples of profitable turnkey investment offers in Turkey:

- Business class complex HASAN BEY RESIDENCE, Antalya, Turkey. The cost of apartments with an area of 53 m² (1 bedroom, 1 living room with kitchen, 1 bathroom) is €160,000. Duplex 4+1 layout (4 bedrooms, 1 living room with kitchen, 2 bathrooms) - area from 126 m², price from €307 000. The estimated payback period for daily rent is 9.8% per annum.

- Comfort class complex HMG GOLD RESIDENCE, Antalya, Turkey. A complex of 20 apartments with high-quality business class finishes, in the historical center of Antalya and 3 minutes from the Mediterranean Sea. Layout 2+1 (2 bedrooms, 1 living room with kitchen, 1 bathroom, 2 balconies) - area 70 m², price from €169,000. The estimated return on investment for daily rent is 9.8% per annum.

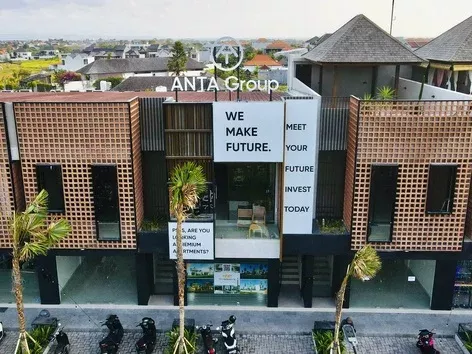

A profitable option for investing in Bali is to purchase premium apartments in ANTA Residence Canggu - a 5* complex with unique infrastructure, in the most fashionable location in Bali, on the main street of Changgu - Batu Bolong and 7 minutes from the Indian Ocean, the beach and the surf spot. The price starts from $135,000 for a studio apartment with an area of 38 m². For your comfort, the international hotel operator RIBAS HOTELS Group (more than 28 hotels under management) will provide comprehensive management of the apartments.

Thus, real estate in Ukraine currently attracts investors with low prices. Ukrainian housing also has high growth potential and tax advantages. At the same time, by investing in foreign real estate, you can reduce risks, diversify your portfolio and make a significant profit.

Read more interesting and expert information about business and investment in foreign real estate on Anton Taranenko's Telegram channel and Instagram page.

We remind you! Earlier we wrote that despite the challenges faced by the tourism industry today, Ukrainian hotels and travel companies are actively improving their strategies to ensure stability and attractiveness for our citizens and foreign visitors. Find out more about how the hotel and tourism business in Ukraine is adapting and continuing to operate in the midst of the war.

More articles on the topic:

Why Turkey is an attractive investment destination: reasons to invest in the Turkish real estate market.

Golden rules of investing: what to look for for successful investments.

Find here the key factors of investment attractiveness of a real estate object.

How to make money on foreign real estate - we tell you here.

Investing in real estate during the war: how to survive in war-torn Ukraine and other parts of the world.

Hotel business in Bali: one of the best hospitality industries.

Reasons for choosing global investment: the power of international investment.

Investing abroad: how to invest in foreign markets.

Want to know more? Read the latest news and useful materials about Ukraine and the world in the News section.

You may be interested in:

Visit Ukraine Donation - make a good deed and an important contribution to the Victory of Ukraine;

Visit Ukraine Legal advice - comprehensive legal support on entry to Ukraine;

Visit Ukraine Tours - the largest online database of tours to Ukraine for every taste;

Visit Ukraine Merch - choose patriotic clothing and accessories with worldwide delivery;

Visit Ukraine News - get the latest news and updates in our Telegram channel;

Cooperation - cooperation and advertising integrations with Visit Ukraine and Visit World projects.

© 2018-2023, Visit Ukraine. Use, copying or reprinting of materials on this site is permitted only with a link (hyperlink for online publications) to Visit Ukraine.

All rights reserved.

Recommended articles

3 min

BusinessUA

Construction business abroad: experience of investor and developer Anton Taranenko

Globalization and access to the international market offer construction companies competitive advantages. However, along with opportunities, there are also certain obstacles. Anton Taranenko, CEO of ANTA Group, an international developer with more than 10 years of experience in the real estate market, spoke in detail about the main trends in the global construction industry and shared the benefits of investing in construction abroad

07 Nov. 2023

More details2 min

BusinessUA

High returns on investments in Bali: dispelling myths with Anton Taranenko

Real estate in Bali has become extremely popular among those looking for a place to invest. In this article, Anton Taranenko, CEO of ANTA Group, an international developer with more than 10 years of experience in the real estate market, spoke in detail about the main trends in the real estate market in Bali, key aspects of investment potential and real returns on investment in Bali

01 Dez. 2023

More details2 min

Der Weg zum Sieg

What's happening to Ukrainian business in the second year of the war?

Despite the war and all the risks associated with staff shortages and the search for new markets and customers, Ukrainian businesses tend to stay in Ukraine and have no plans to relocate. Find out what else was revealed in the new Gradus Research study

13 Jan. 2024

More details1 min

BusinessUA

Ukraine has simplified conditions for large investors: what is changing

The new government decree not only simplifies the conditions for investors, but also introduces a number of key changes aimed at stimulating investment activity in the country. One of these changes is the revision of the procedures for feasibility studies of investment projects, making them more accessible and understandable. Find out more about why this is an important step

06 Feb. 2024

More details