Individual entrepreneurs can now easily pay their taxes through the Diia app with just a few clicks. Find out more about which groups of sole proprietors are eligible for this method, what you need to do, and how to do it

At the beginning of the full-scale war in Ukraine, state registries were disabled for security reasons. However, the Ministry of Digital Transformation of Ukraine, together with the State Tax Service, managed to restore the operation of a set of registers related to tax services. Currently, Ukrainian entrepreneurs can pay taxes through the Diia app. The article below explains who can use the app and how to do so.

Read this article to find out how to file a sole proprietorship's reports through the tax app.

How to pay taxes as a sole proprietor using Diia?

First of all, this service will be useful for sole proprietorships without employees on the simplified taxation system. So, in order to pay taxes through Diia:

1. Go to the mobile application and log in to the system.

2. Select the category of service and go to the section “Taxes of individual entrepreneurs” (in the upper field you will see the taxes that are available for payment).

3. Select “Payment of taxes and fees” and select the required tax from the list, as well as the period for which you are paying.

4. Click the “Pay” button.

There are two options: “Pay with Google Pay” or “Pay by card”, choose the one that suits you best. If you want to pay by card, you will need to enter your card details. After filling in all the fields, you will only need to confirm the payment with the “Pay” button. Thus, the information will be recorded and the tax will be transferred to the budget. And the next business day you will be able to check this credit.

Visit Ukraine on social media: Telegram | YouTube | Instagram | Facebook | Twitter | TikTok

How do I submit a single tax return using Diia?

If you have chosen the “2% Single Tax Return”, follow these steps:

1. Click “Submit”.

2. Select the period for which the income is declared.

3. Enter the amount of income (the tax amount is deducted automatically).

4. Enter a contact phone number.

5. Check the accuracy of the information before signing the declaration.

6. Sign the document with an electronic signature.

In addition to transferring taxes, other functions are available in Diia. You can see detailed information about the taxation group, tax rate, and taxation system at the bottom of the field. After clicking “More detailed information”, you can view information about registration as a single social contribution payer and a single tax payer, as well as information about bank accounts opened in your favor as an individual entrepreneur.

If you need expert advice on registering and doing business in Ukraine, please contact Visit Ukraine's lawyers. Our team provides consulting services at the stage of registering your own business, as well as post-registration support, including advice on further business operations, accounting, taxes, and other issues. In addition, you can order a turnkey service for registering a sole proprietorship or LLC in Ukraine, which will include full support at all stages of starting your own business. You can order a legal consultation by following this link.

Do you have additional questions? Contact the Visit Ukraine hotline (Telegram | WhatsApp).

We remind you! Ukrainians and foreigners registered as sole proprietors can make changes to their sole proprietorship online. Read what data can be changed, how much the service costs in Diia, and how it works in our previous article.

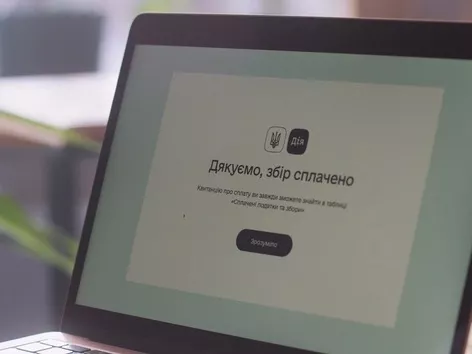

Photo: Diia

Want to know more? Read the latest news and useful materials about Ukraine and the world in the News section.

Ihor Usyk is the Head of Legal Department at Visit Ukraine

We recommend purchasing it for a safe and comfortable trip to Ukraine:

Visit Ukraine Insurance – safe travel in Ukraine (insurance covering military risks);

Visit Ukraine Legal advice – comprehensive legal support on entry to Ukraine;

Visit Ukraine Tickets – bus and train tickets to/from Ukraine;

Visit Ukraine Tours – the largest online database of tours to Ukraine for every taste;

Visit Ukraine Hotels – hotels for a comfortable stay in Ukraine;

Visit Ukraine Merch – patriotic clothing and accessories with worldwide delivery.

© 2018-2024, Visit Ukraine. Use, copying or reprinting of materials on this site is permitted only with a link (hyperlink for online publications) to Visit Ukraine.

All rights reserved.

Recommended articles

1 min

Finance

How have taxes for sole proprietorships changed in 2024 and what to expect next?

The Ukrainian government has fixed a plan to increase taxes for individual entrepreneurs and set a new level of subsistence minimum and wages, which accordingly affected the amount of taxes for individual entrepreneurs of groups I-III. Find out how much individuals now have to pay and what other changes to expect in the near future

05 Jan. 2024

More details2 min

Finance

According to the Tax Code, Ukrainians who are abroad and have income but have permanent residence in Ukraine are residents of Ukraine. This means that they must file a tax return. We will explain in detail how to do this, who is obliged to pay taxes twice and what fee will have to be paid in any case

18 Sep. 2024

More details2 min

For foreigners in UA

Peculiarities of income taxation: when do foreigners have to pay taxes in Ukraine?

Ukrainian law does not prohibit foreigners from being employed and doing business in Ukraine, but income earned in the country is subject to mandatory taxation. Find out in which cases foreigners are required to pay taxes, as well as how the system of double taxation and e-residency works in Ukraine

19 Apr. 2024

More details1 min

Transport

Car customs clearance in Diia: when will it be available?

The Verkhovna Rada of Ukraine has voted in the first reading for a draft law that will allow customs clearance of cars in Diia. Find out what the new rules provide for and when the service will become available

01 May. 2024

More details